Forex Advisory

Foreign exchange risk (currency risk) is a financial risk posed by an exposure to unanticipated changes in the exchange rate between two currencies. Corporates and multinational businesses exporting or importing goods

and services or making foreign investments throughout the global economy are faced with an exchange rate risk which can have severe financial consequences if not managed appropriately. SYNERGY provides services

to SMEs & Corporates to effectively manage your Exchange Rate Risk and mitigate the effects of volatility in the Foreign Exchange Market. Our Forex Advisory Services assist in drafting Forex risk management policies

to setting up benchmark methodology and managing Forex risk throughhedgingstrategies.

Through our services, we assist companies in forward booking the best possible prices to counter the currency fluctuations

& to receive their payments at the best possible rates. Our primary objective is to ensure that we provide companies with all relevant inputs and advice to mitigate Forex risks.

Information Services

One of the most important pre-requisite of evolving any strategy or taking any decision is the correct information about the market movement. We have observed in most of the cases corporate suffer due to lack of timely

information and as a result they are never in a commanding position with their banks while negotiating the documents. Being Forex service provider, we provide correct and neutral market information, which leads

to monetary and opportunity gains. We keep our clients update about the market movement through email and SMS alerts. Facility of sending short sms which consist of the major currency pairs, equity indices. The

idea is to update the market participants with the latest market data, empowering them in timely decision making.

Foreign Exchange Risk Management Policies

Well articulated policies, setting forth the objectives of the institution's foreign exchange risk management strategy and the parameters within which this strategy is to be controlled, are the focal point of effective

and prudent foreign exchange risk management. These policies need to include:

-

Well articulated policies, setting forth the objectives of the institution's foreign exchange risk management strategy and the parameters within which this strategy is to be controlled, are the focal point of effective and prudent foreign exchange risk management. These policies need to include:

-

explicit and prudent limits on the institutions' exposure to foreign exchange risk ; and

-

clearly defined levels of delegation of trading authorities.

International Debt Syndication (Import of capital and Non capital Goods)

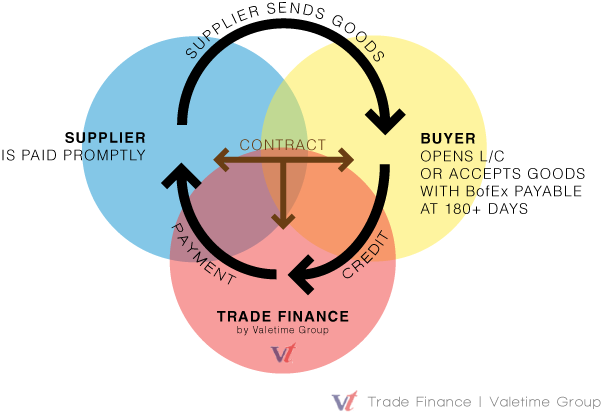

Suppliers Credit

Supplier's Credit is a financing arrangement under which exporter or overseas bank extends credit to importer for his purchases. Here LC is being issued by importer's bank, in which they undertakes to pay to supplier

or overseas bank after the usance period as agreed in the LC terms. The same is funded by overseas bank, the exporter gets the payment at sight basis and importer needs to repay to overseas bank after the usance

tenor.

Buyers Credit(For Indian corporates)

Buyer's credit is facility available for Indian importers, to borrow in foreign currency against their import liability. Import can be against documents or LC with at sight or usance based payment terms. Same can be

availed for maximum period up to 360 days in case of Raw Material and 5 years in case of capital goods from bill of lading date. The lender can be foreign bank or foreign branches of Indian bank, which agrees to

lend at Libor based interest rate based on Letter of Undertaking (LOU) or Letter of Comfort (LOC) provided by Importer's Bank. In LOC/LOU, the importer's bank will undertake to repay the loan on maturity with interest

to lending bank.

Debt Syndication

Synergy offers services to SMEs & large corporates in syndication of debt, as well as, in restructuring of existing debt. For all the products, we offer a range of services under the category of debt syndication. The

nature of these services varies from one client to another as per the nature of their businesses. We provide turnkey solutions for their requirements of :

Invoice Factoring

Supplier's Credit is a financing arrangement under which exporter or overseas bank extends credit to importer for his purchases. Here LC is being issued by importer's bank, in which they undertakes to pay to supplier

or overseas bank after the usance period as agreed in the LC terms. The same is funded by overseas bank, the exporter gets the payment at sight basis and importer needs to repay to overseas bank after the usance

tenor.